Calculate depreciation of furniture

Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice. Depreciation purchase price salvage valueestimated useful life.

Depreciation Nonprofit Accounting Basics

This depreciation calculator will determine the actual cash value of your Leather Furniture using a replacement value and a 20-year lifespan which equates to 02 annual depreciation.

. Age specific including cots changing tables floor sleeping mattresses high and low feeding chairs and stackable beds 5 years. You can use different methods to calculate depreciation. To calculate depreciation using the straight-line method subtract the assets salvage value what you expect it to be worth at the end of its useful life from its cost.

To do that look in your property tax assessment for how the government valued your property and figure out the percentages x structure y property Take your purchase price or. In year one you multiply the cost or beginning book value by 50. Online furniture depreciation calculators.

Depreciation is handled differently for accounting and tax. Depreciation per year Book value Depreciation rate. Lets say the furniture has a useful life of 8 years.

The depreciation of an asset is spread evenly across the life. There are many variables which can affect an items life expectancy that should be taken into consideration. You then find the year-one.

There are a few methods for calculating furniture depreciation including. The calculator should be used as a general guide only. The straight-line method means you divide the value by its useful life.

The basic formula using straight line depreciation is purchase price less salvage value divided by the total number of years of useful life. This represents the annual. Doing this will give you an average depreciation.

Determine the useful life of the furniture. You bought a cabinet for 1000 and you expect to use it for the next 10 years. There are many variables which can affect an items life expectancy that should be taken into consideration.

Depreciation in Any Period Cost - Salvage Life Partial year depreciation when the first year has M months is taken as. The calculator should be used as a general guide only. Divide the cost of the furniture 19500 by the useful.

The DDB rate of depreciation is twice the straight-line method. The basic way to calculate depreciation is to take the cost of the asset minus any salvage value over its useful life. How to Calculate Furniture Depreciation.

Calculate annual depreciation expense. Furniture used by children freestanding.

Accumulated Depreciation Explained Bench Accounting

Editable Balance And Income Statement Income Statement Balance Etsy In 2022 Income Statement Small Business Plan Template Financial Statement

Depreciation Formula Calculate Depreciation Expense

Depreciation Of Furniture And Fixtures Download Scientific Diagram

How To Calculate Depreciation Expense For Business

13 Depreciation Schedule Templates Free Word Excel Templates Schedule Templates Excel Templates Templates

Balance Sheet Templates 15 Free Docs Xlsx Pdf Balance Sheet Template Balance Sheet Accounting

Balance Sheet Income Statement Financial Etsy Income Statement Balance Sheet Financial Statement

Depreciation Formula Calculate Depreciation Expense

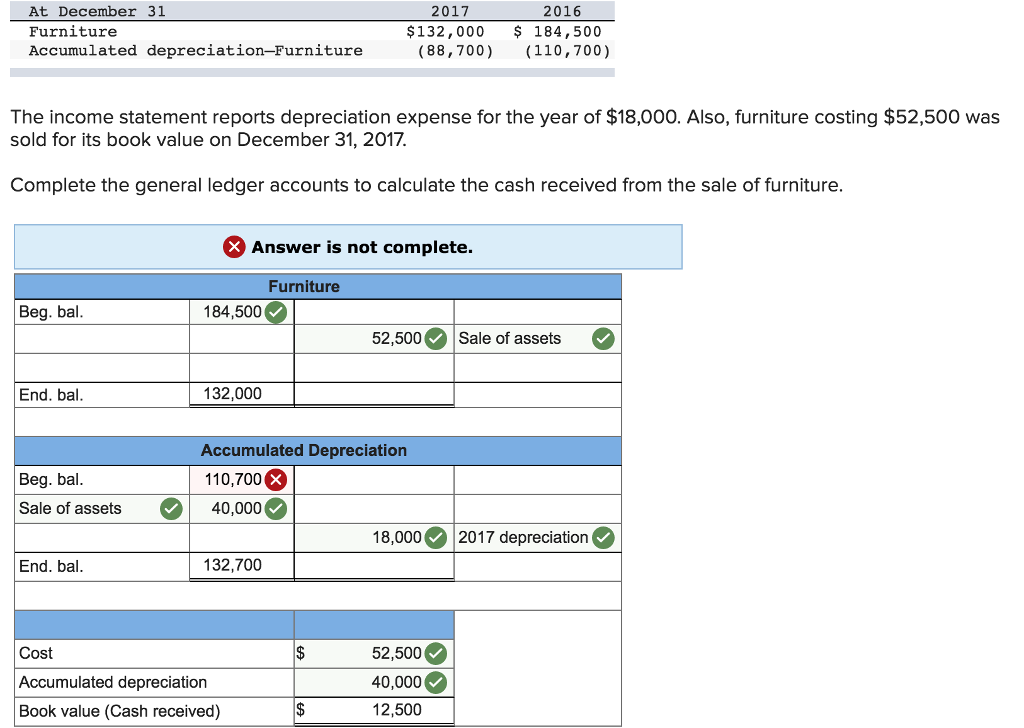

Solved At December 31 Furniture Accumulated Chegg Com

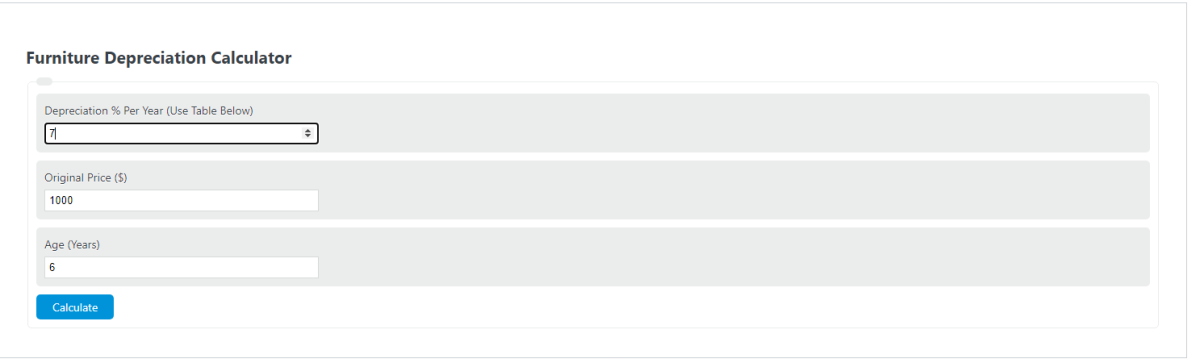

Furniture Depreciation Calculator Calculator Academy

![]()

Furniture Calculator Splitwise

Depreciation In Income Tax Accounting Taxation Income Tax Income Energy Saving Devices

Furniture Depreciation Calculator Calculator Academy

Balance Sheet Template Download Excel Worksheet Balance Sheet Balance Sheet Template Fixed Asset

Assets And Liabilities Spreadsheet Template Balance Sheet Template Spreadsheet Template Balance Sheet

Depreciation Nonprofit Accounting Basics